By Norhafiza Nordin and Zaemah Zainuddin

“Islamic crowdfunding offers better protection for investors compared to conventional crowdfunding. It offers more choices of Islamic products to investors to choose from and at the same time helps those who need capital by channeling funds to productive projects,” is a commonly heard phrase.

Some people are hesitant to invest because they believe it is a difficult and risky procedure. Rather than investing in high-yield investment products, many people choose lower savings account returns. Despite this, savings account returns are insufficient to deal with today’s rising living costs.

Therefore, rising living expenses have led people to look for more alternatives to create and accumulate wealth. Investment products offer better opportunities to earn higher returns.

As an investor, we should look at the real rate of return instead of the nominal rate of return. A real rate of return takes into consideration the impact of an inflation rate. This is important because as the inflation rate increases, the purchasing power decreases.

Therefore, an investor should invest in a product that offers a higher expected rate of return than an inflation rate.

Nevertheless, high-earned return or profit is not the only factor for Muslims to consider when looking for investment alternatives. Another crucial factor is that the investment products must be Shariah-compliant.

Islamic crowdfunding was one of the investment solutions that were developed to fulfill this need. Introduced and advanced in conjunction with the rapid growth of fintech, this halal investment alternative offers Muslims the opportunity to invest in a product that does not involve activities that are forbidden (haram).

What is Crowdfunding?

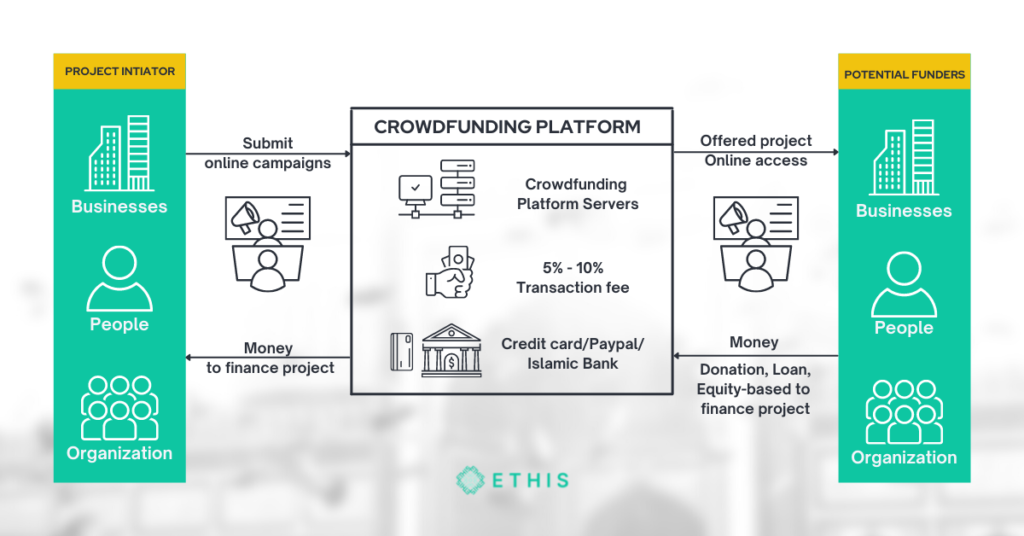

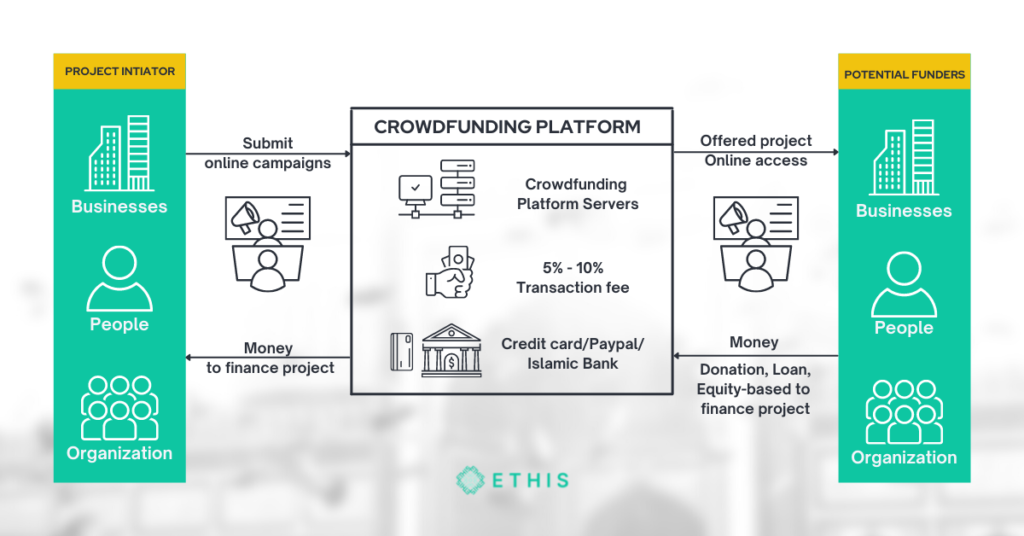

Crowdfunding, in general, is a method of raising capital through the internet from a large pool of individuals. Specifically, it is a way of raising funds from the public by marketing campaigns through social media to share information, pictures, videos and details about a project. Crowdfunding has gained popularity among fundraisers due to its simpler procedure compared to the traditional fundraising methods, such as bank loans.

This also creates more investment opportunities for investors. Crowdfunding involves a tripartite relationship, which consists of the crowdfunding platform (CFP) operator, the fund seekers or issuers (entrepreneur) and the crowd funders (aka the investors or donators).

The crowdfunding operator is responsible for providing and managing an online platform to enable the issuers to reach the crowd funders. The issuer or entrepreneur provides information regarding a project, which can be anything from charity to new product development.

Types of crowdfunding

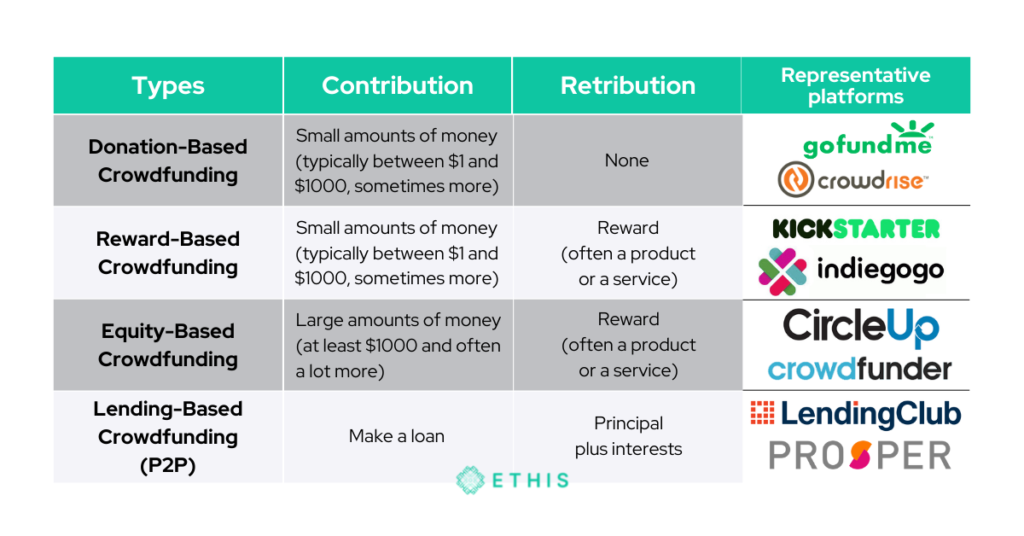

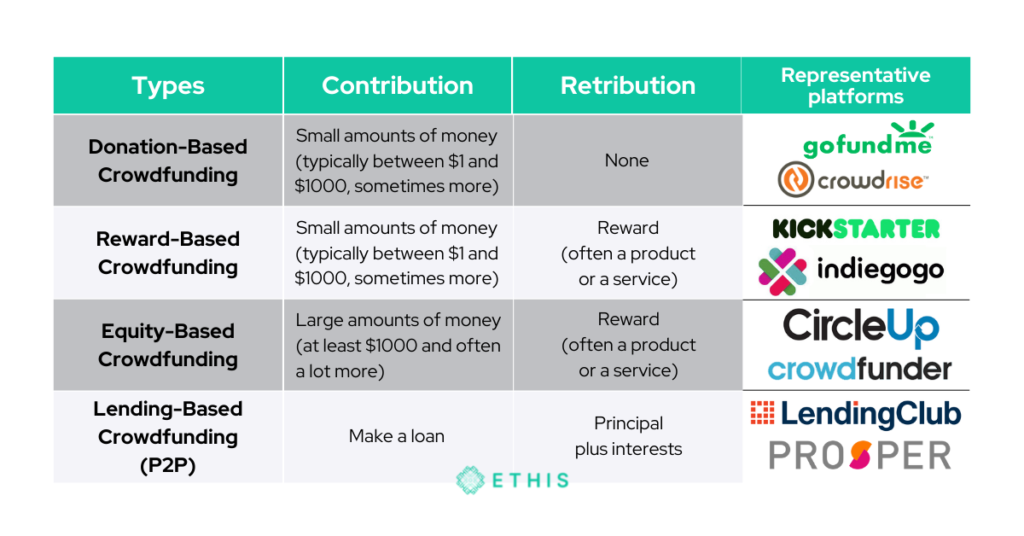

The crowd funders offer financial support in return for a reward or profit depending on the type of crowdfunding. In most cases, crowdfunding can be divided into four types. They are:

1. Donation

Donation-based crowdfunding systems allow contributors to direct their donations (no matter how little) to a variety of causes. People from all around the world may post their non-profit initiative, cause, or emergency circumstances and ask for aid in achieving their social and humanitarian aims. These platforms, in general, charge minimal fees to assist solicitors in reaching a worldwide audience at affordable rates.

Donors contribute without expecting any return or financial reward. Most contribute to the satisfaction of donating to a worthy cause. Examples include campaigns to help individuals involved in an accident, natural disaster or famine. There are several large donation-based platforms available such as GlobalSadaqah.

2. Reward

Reward-based crowdfunding grew in popularity since it provided new avenues for financing to a group of people previously considered unbankable.

This class has little possibility of obtaining bank funding due to the significant risk connected with their projects and the lack of collateral to back their loan application. KickStarter.com and Indiegogo.com are two well-known websites that allow anyone to propose their concept to the entire globe via their platforms.

Reward-based crowdfunding offers entrepreneurs a platform to raise capital from individuals in return for a product or service without having to repay a loan.

Campaigns usually involve new projects that are still under the research and development stage. Frequently, an entrepreneur has a good idea but inadequate funds to proceed with the production.

By introducing the project or business idea on a crowdfunding platform, people might be attracted to chip in, in return for a reward. A token gift, an exclusive release and a limited edition of a product or service are examples of rewards offered. Examples of products that had managed to attract crowd funders to participate include smartwatches, card and board games.

3. Equity

This calls for the crowd to usually fund a startup or small to medium-sized business. Companies can issue shares and raise cash through this form of crowdsourcing. The funders are promised the ordinary shares of the newly formed company. These ordinary shares give them equal rights in the company as any common shareholders would have.

Given its availability and cost-efficiency compared to traditional finance models, many start-ups and small businesses opt to employ this alternative source of funding. Investors who acquire shares for a low price must wait for an exit plan to be available before they can cash out (like an IPO or a buyout scenario).

In an ideal world, investors’ money would increase by a factor of ten, but investors could also be in danger of losing everything. Equity crowdfunding also known as ECF for short provides opportunities for the average person to invest as they require a small amount of money.

4. Peer to Peer Lending (P2P)

This mechanism relates to the lending of money by the crowd in return for interest payment. P2P Platforms operate as a middleman between potential investors and borrowers. Parties requesting funding must explain why they require a specific quantity of money and what kind of returns they are ready to provide. The crowd is promised a return on the capital invested together with an interest payment at maturity. The interest rate is normally set based on the credit assessment of the fund seeker.

Neither capital nor profits are guaranteed, and the risk is because many of the companies involved are start-ups or small businesses; thus, the probability of default is also higher. While there is no actual cost of funds when compared to banks and other lending organizations, lending returns are greater and more appealing than market returns.

The key difference between conventional crowdfunding and Islamic crowdfunding lies in the application of Islamic principles in the latter.

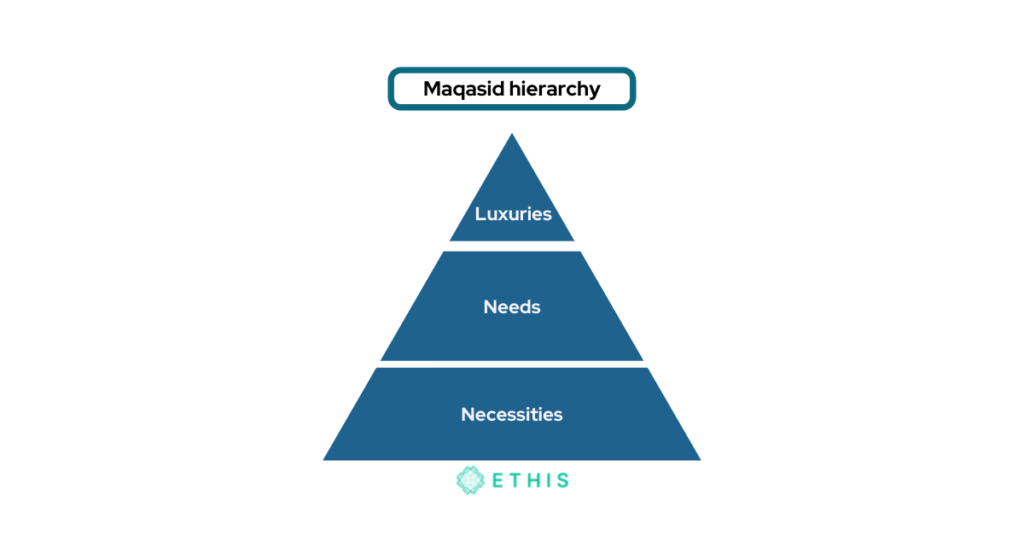

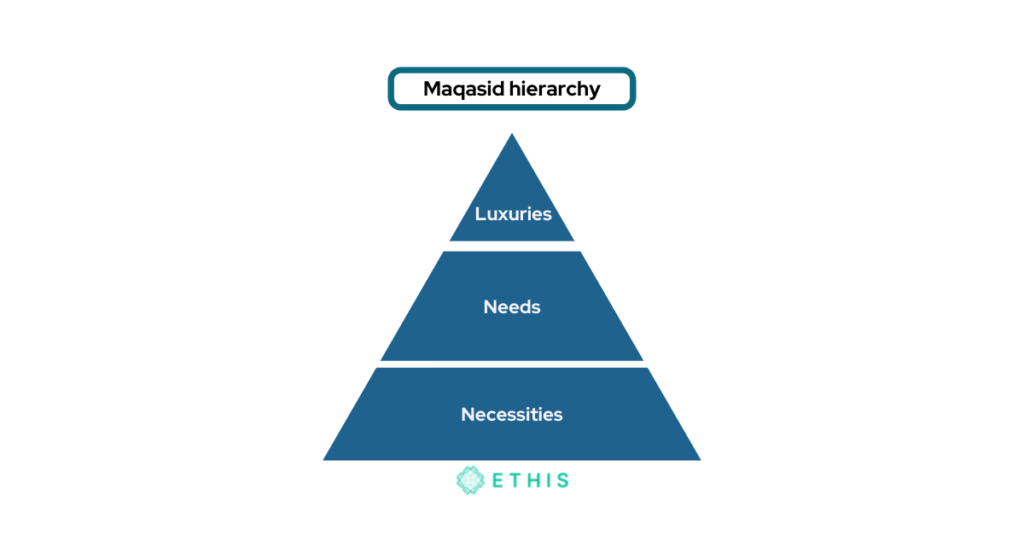

Maqasid-Shariah or Objectives of Shariah has always been the guideline used to assess the compatibility of Islamic products or businesses with Shariah principles. The concept of Islamic crowdfunding can be analyzed using three different classes of Maqasid-Shariah:

Darruriyat (Necessity): The use of crowdfunding in an Islamic financial platform could be an opportunity for Islamic finance to grow. The process of giving entrepreneurs the opportunity to get funds using crowdfunding reflects the trust placed in new businesses or projects. The continuity of their businesses depends on this type of funding. Islamic crowdfunding reduces the time and cost of doing business which is compatible with the Islamic way of doing business by having the right information and no uncertainty.

Hajjiyat (Needs): Difficulty in obtaining funds from financial institutions could cause new businesses and projects to be abandoned. Such a scenario goes against the Maqasid Shariah since Islam encourages people to live without having difficulties. As the economy needs to grow, so does the new business. The funding from Islamic crowdfunding will encourage more Islamic entrepreneurs to start new ventures and businesses without having to depend on conventional interest-based financing.

Tahsiniyat (Luxuries): In Islam, it is permissible to want a better life above the normal standard. Therefore, through Islamic crowdfunding, businesses can grow and gain more profit without the problem of capital rationing. With the expansion in the economy, more zakat money from businesses can be collected and used to build a better “Ummah” and society.

Conventional crowdfunding + Shariah principles applied = Islamic Crowdfunding.

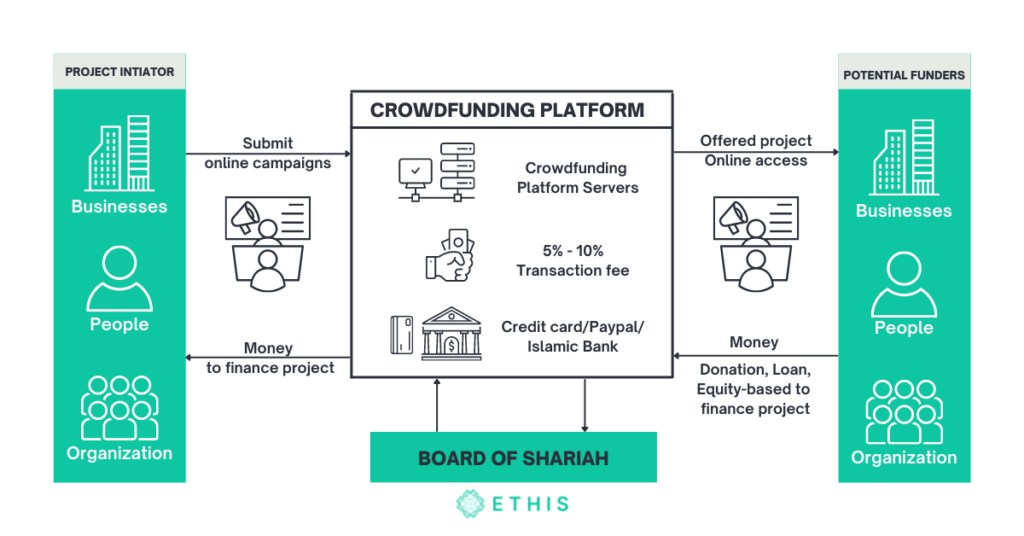

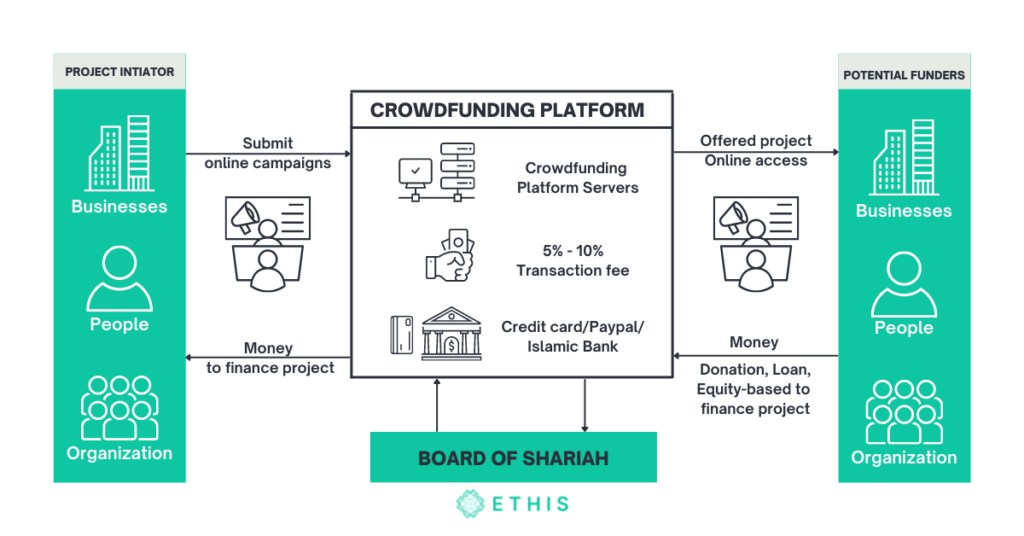

In addition to the three parties involved in conventional crowdfunding, another important party of Islamic crowdfunding is the Shariah committee. In other words, for Islamic crowdfunding, four parties are involved. They are the fund seeker, the funder or investor, the platform operator and the Shariah committee.

To be qualified as an Islamic crowdfunding platform, all operations and procedures must be Shariah-compliant. All transactions and activities must not involve prohibited elements such as gharar (uncertainty and riba (interest).

The committee is responsible for ensuring that the operation strictly adheres to Shariah principles and practices. They must carry out regular assessments and audits on the crowdfunding platform.

Ethis is an example of a Shariah-compliant crowdfunding platform. It is the first fully Shariah-compliant equity crowdfunding platform. Approved by the Malaysian Securities Commission, it appeals to a wide range of risk appetites and financial capacities globally.

Related: Shariah-compliant Equity Crowdfunding

Figure 1 and Figure 2 show the basic structure of conventional crowdfunding and Islamic crowdfunding respectively.

Let’s take peer-to-peer (P2P) crowdfunding as an example. P2P Islamic crowdfunding has the same structure and standard operating procedure as conventional P2P. However, since it must be Shariah-compliant, it must be free from any interest-based contract. Instead, it adopts a profit-sharing agreement that allows investors to share a pre-agreed percentage of profit from the financed projects.

Two popular Islamic P2P models are Mudharabah and Murabahah.

Mudharabah refers to the concept of a profit-sharing agreement. It focuses on the percentage of profit sharing that is determined mutually, but the loss is borne by the financier or funder. In brief, under the Mudharabah concept, the funder shares a percentage of the profit but assumes losses.

As for Murabahah, it refers to a sales contract where both parties agree on the markup or “cost-plus” price for the product.

Ethis also operates a P2P Islamic Crowdfunding platform in Indonesia. Its impact investment platform has been making waves over the years and has been recognized with awards. Since 2016, around 8,000 affordable homes have been developed by investors from 65 nations.

Ethis’ also runs a charity crowdfunding platform to facilitate charity crowdfunding around the world. This global platform allows for effective charity and Islamic social finance. Now you can give Sadaqah, Zakat and Waqf online to credible charities and social enterprises alongside corporates and high-net worth individuals.

Ultimately, the emergence of Islamic crowdfunding gives halal investment options for investors seeking to participate in crowdfunding while also desiring a Shariah-compliant product.

Islamic crowdfunding, in comparison to traditional crowdfunding, provides superior security for investors due to the strong rules of Islam, which severely forbid purposefully risky and damaging practices. It provides investors with a wider range of Islamic products to choose from while also assisting people in need of cash by reallocating resources to productive initiatives.

However, unlike some other Shariah-compliant items, Islamic crowdfunding is not limited to Muslims. It is available to everyone, and investors can invest based on the product’s performance and risk tolerance.

For those looking for an alternative to traditional P2P crowdfunding, P2P Islamic crowdfunding is a fantastic option. Because there is no fixed-return interest, it might theoretically give larger yields, and, more significantly, risks are shared across the board in the pursuit of productive goals.

Islamic crowdfunding already has a natural layer of regulations prohibiting various destructive objectives or concerns because it is founded on Islamic beliefs. Not only is the safety of investors essential, but so are societal interests.

Islamic crowdfunding platforms like ethis.co are proof of this. Although still in its infancy, Islamic crowdfunding has the potential to develop into a comprehensive investment channel, allowing investors to pursue social goals while receiving above-market profits.

Discover the most recent articles on our blog and become part of our thriving community today!

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You