The history of crowdfunding dates back to the early 18th-century Ireland, where “forefather of microcredits” Jonathan Swift founded the Irish Loan Fund. The Fund offered small loans to low-income rural families who did not have the collateral required by large banks or proper credit history. By the 19th century, there were more than 300 schemes in Ireland that offered small loans by private investors to individuals who needed money for short periods. In today’s terms, this is known as peer-to-peer (P2P) lending, one of the main types of crowdfunding.

Crowdfunding in today’s context is still an evolving ecosystem. Crowdfunding platforms have emerged in many countries as an alternative source of funding for businesses to raise capital without the need to go through lengthy bank processes and stringent requirements. The platforms connect potential issuers (fundraisers/borrowers) directly with investors who are interested in financing their projects or ventures.

There are a few different types of crowdfunding. In this article, we are going to compare and contrast two types, i.e. equity crowdfunding (ECF) and peer-to-peer (P2P) lending.

Related: Investing through Equity Crowdfunding (ECF): The Pros and Cons

Let’s start with the definition.

What is equity crowdfunding and P2P lending?

Equity crowdfunding is a method for private companies, known as issuers, to raise funds for their ventures via equity shares. The issuer offers their company’s equity in exchange for the funding from the ‘crowd’. The crowd gains a stake in the company in return for the money invested.

On the other hand, P2P lending, also called P2P financing or marketplace lending in other countries, is a way for businesses to borrow money from individual lenders. It’s a form of direct lending of money without the participation of a financial institution such as the banks as an intermediary.

Both are alternative sources of funding that offer financing mechanisms for micro, small and medium enterprises, as well as the “unbanked.” They disrupt the traditional banking system by enabling businesses to obtain capital from a pool of investors via an online platform.

Before the advent of equity crowdfunding and P2P lending

Traditionally speaking, investing in early-stage or growth-stage ventures was only restricted to accredited investors and high net worth individuals, i.e. investors with a certain defined level of income or assets, who can afford the high minimum investment amount that comes with high risks, and high potential returns.

Equity crowdfunding has allowed non-high-net-worth individuals to own a portion of the equity of a private company. It makes such investment accessible to a larger pool of investors by offering a much lower minimum investment amount than it used to be.

Related: Diversify Your Investment Portfolio with Equity Crowdfunding

On the contrary, money lending was predominantly a bank’s game. The advent of P2P lending has offered an alternative financing option for borrowers looking to borrow money. It eliminates the role of a bank in the borrowing transaction while enabling individuals to offer loans to business owners directly, and subsequently earn returns via P2P platforms.

How do investors earn returns from equity crowdfunding and P2P lending?

Equity crowdfunding

As with any investment, investing via equity crowdfunding does not guarantee returns, and your capital may be at risk. Furthermore, investing in early-stage companies carries a high degree of risk including the risk of business failure and bankruptcy. But with high risk comes high potential returns should the business flourish.

Here are four of the more commonly known ways for equity crowdfunding investors to make money from the investment.

1) Share buyback

Unlike investing in stocks, equity crowdfunding investments are relatively ‘illiquid’, which means you can’t easily sell your shares and exit your investment. But as part of the exit strategy, some issuers may offer a buyback option at a certain target price within a predetermined time frame. This allows investors an opportunity to exit their investments and earn their returns.

One of our latest issuers, Baloy, which raised RM6.16 million in equity crowdfunding, one of the highest ECF amounts in Malaysia, for example, is targeting a buyback within 36 to 60 post-ECF fundraise, at a target price that matches the issuance price.

2) IPO

Initial public offering, or IPO, is another exit strategy offered by the issuers to equity investors. Generally, once a company reaches a certain size, it may wish to scale the business further by going public. Once the company is listed, investors have the option to exit their investment by selling their shares at a market-determined share price and enjoy the benefits of capital appreciation due to higher valuation at the time of IPO.

3) Mergers and acquisitions

A merger is where two or more companies combine to form a single entity. An acquisition, on the other hand, is where another company purchases a majority of one’s company shares and takes control of the company direction. When either of these occurs, investors are presented with the opportunity to sell their shares at a higher price and exit the investment.

4) Dividends

Similar to investing in public listed companies, equity crowdfunding investors are entitled to earn dividends per annum should the company they invest in hits its projected net profit based on its projected financials for the year. The dividends payout ratio varies from one issuer to another, depending on their targeted offer during the equity crowdfunding campaign. Investors still maintain their stake in the company while also receiving the dividend payments proportionate to their shares in the company.

Related: Crowdfunding: A New Way to Grow Your Wealth

Peer-to-peer lending

In conventional P2P lending, lenders profit from the money lent via interest paid. They will receive interest payments as returns on their investment. It’s a form of riba and is therefore not permissible in Islam.

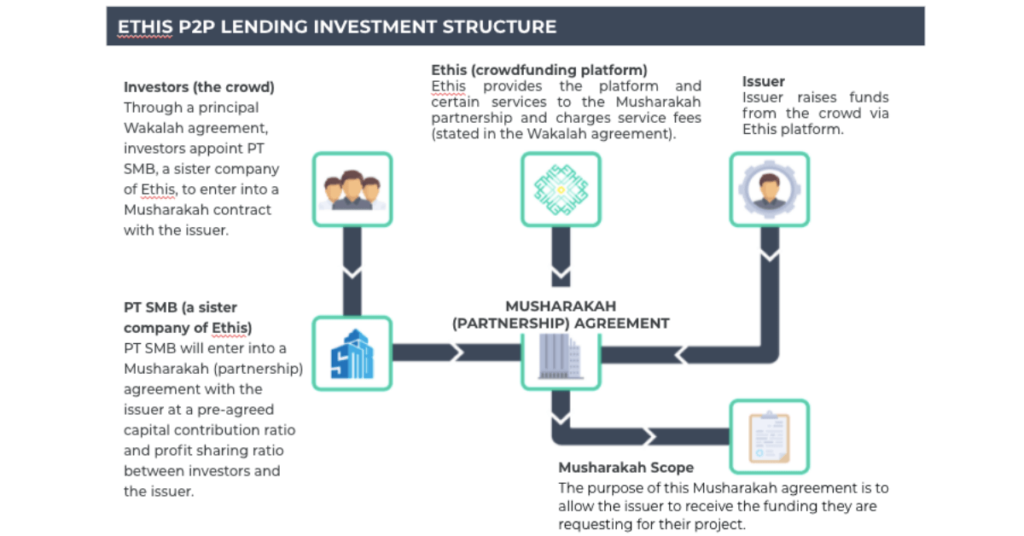

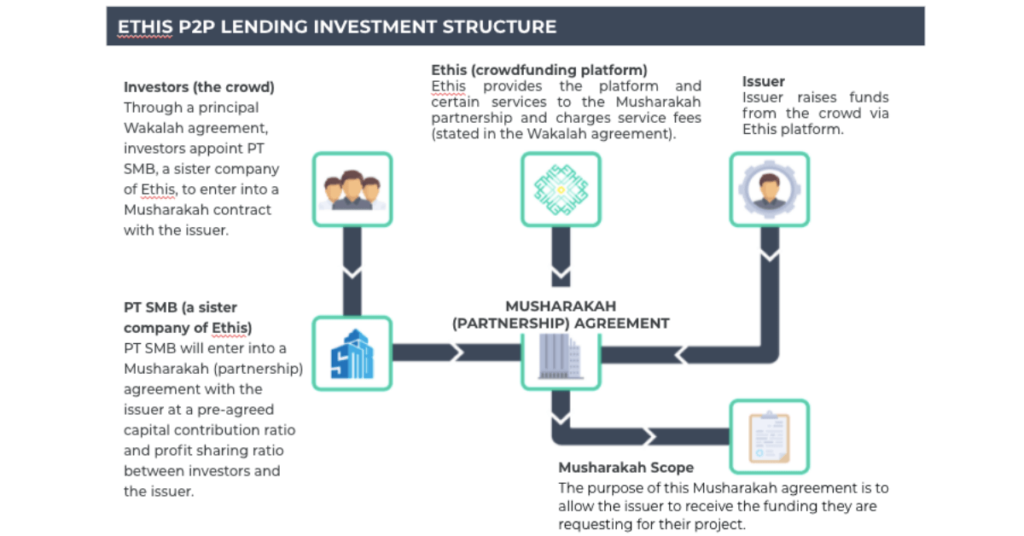

Shariah-compliant P2P lending, on the other hand, is based on an Islamic sale contract that requires a product, commodity, or service as a trade-off of the financing, and/or profit-loss partnership. Investors earn returns based on a pre-agreed Profit-Sharing Ratio (PSR) and bear loss proportional to their contribution in the capital of the partnership.

At Ethis, our P2P lending transaction is based on a limited-scope joint-ventures partnership known as musharakah. Through a wakalah agreement, investors appoint PT SMB, our sister company, to enter into a musharakah partnership with the issuer on their behalf at a predetermined capital contribution ratio and profit sharing ratio between the issuer and investors.

Upon completion of the project and receiving their payment, the issuer will pay back investors’ capital together with the profit (if any) and the musharakah partnership will be dissolved.

Let’s recap the key similarities and differences between ECF and P2P lending via the comparison table below.

| No | Equity Crowdfunding (ECF) | Peer-to-peer (P2P) Lending |

| 1 | A method for a private company, known as an issuer, to raise funds for their ventures via equity shares. Investors gain a stake in the company in return for the money invested. | A method for businesses to get a loan from individual lenders (investors) directly without the intermediary of a financial institution such as the banks. |

| 2 | Investors make money from the investment either via dividend payout, share buyback, or when the company goes public, merges with, or is acquired by another company. | Investors earn profit from the money lent based on a pre-agreed profit sharing ratio. |

| 3 | Both are alternative sources of funding that offer financing mechanisms for micro, small and medium enterprises, as well as the “unbanked”. They disrupt the traditional banking system by enabling businesses to obtain capital from a pool of investors via an online platform. |

Ethis is the world’s leading ethical investment crowdfunding platform. We have our branches and representative offices in Malaysia and Indonesia.

#CirculateGood with our global community of impact investors by investing in promising high-growth companies via ECF campaigns and profitable projects via P2P lending on our platform. Check out ethis.co today!

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You